Foreign issuers enrich Swiss bond market

The Swiss franc bond market offers a broader selection thanks to foreign debtors. Investors are benefiting from this.

Authors: Edgar Salzmann Christopher Radler

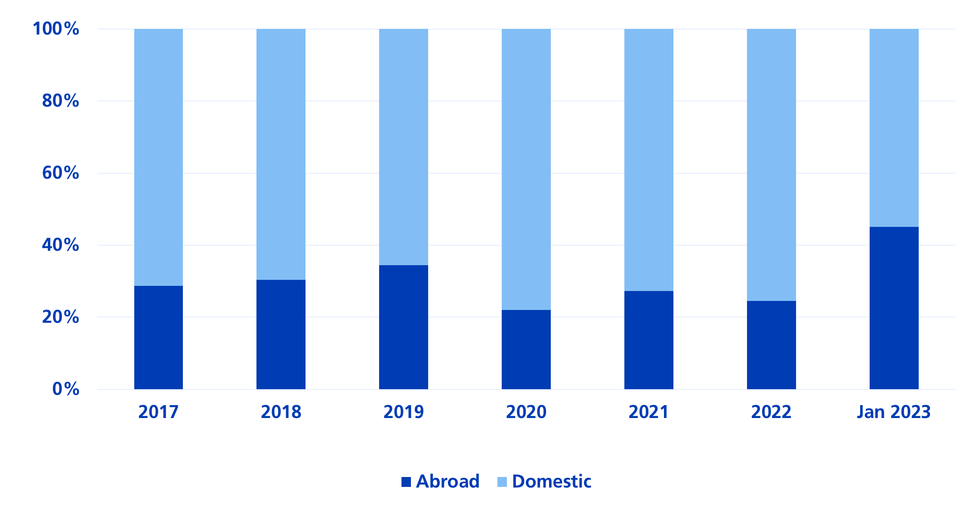

The issue business for bonds traded in Swiss francs (CHF bonds) had a brilliant start to the new year. In the first three weeks, bonds with a nominal value of around CHF 10 billion were issued. What is particularly pleasing is that foreign debtors have returned. Their market share in terms of issue volume is over 40 per cent (as at the end of January 2023).

International issuers expand their presence (Swiss Bond Index AAA-BBB)

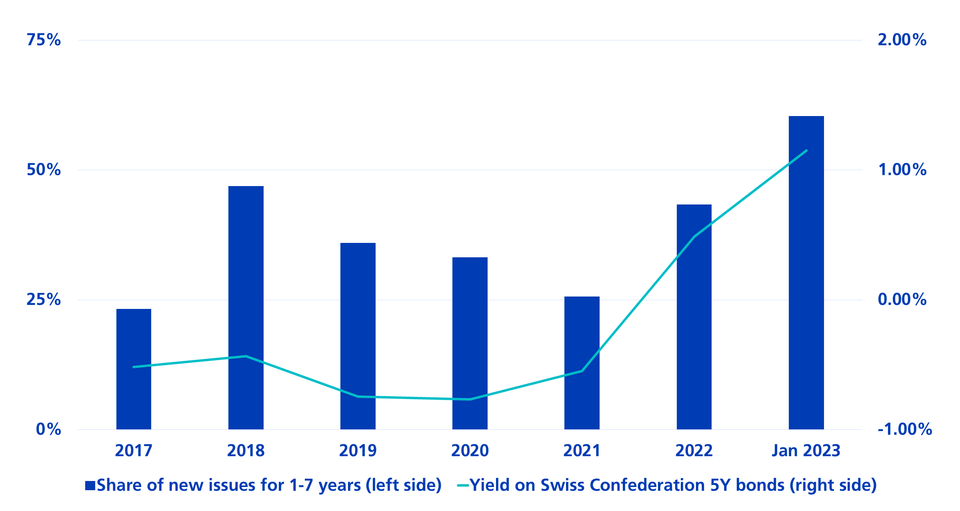

The turnaround in interest rates has sparked an issue extravaganza

- There are three main reasons why foreign debtors want to enter the Swiss bond market:

The Swiss National Bank's key interest rate hikes ended the long phase of negative interest rates. Bonds and money market investments denominated in Swiss francs are therefore delivering significantly positive returns again. These asset classes are becoming attractive alternatives to the savings account for an increasing number of investors.

The turnaround in interest rates is fuelling issues of short and medium-term CHF bonds

- Foreign issuers are exposed to currency volatility risk. For this reason, they usually hedge using currency swaps. However, they only borrow funds in the CHF market if they can hedge these liabilities in their home currency, usually USD or EUR, at favourable conditions. These conditions are currently favourable, especially in the maturity range between three and five years. This explains why so many new bonds with maturities between 2026 and 2028 are currently being launched.

- Central banks are reducing their balance sheets, which have been inflated by bond purchase programmes. This means that large, reliable buyers of EUR and USD bonds have gone. Generally, smaller markets offer less liquidity and a smaller number of potential investors compared to larger markets such as the USA or Europe. The CFOs of foreign issuers are therefore also looking towards the peripheral, i.e. smaller bond markets, which also include the Swiss market.

Welcome diversification

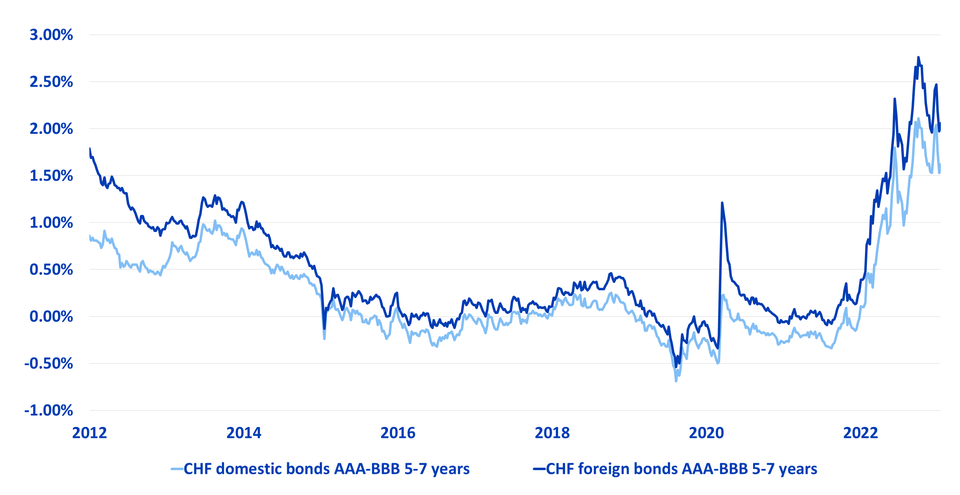

The increased presence of global issuers is highly welcome, as the market is currently dominated by domestic debtors. The two Swiss Pfandbrief institutions and the Swiss Confederation alone account for around half of the overall market. Thus, from the investor's perspective, any expansion of the debtor range is encouraging. This makes it possible to construct more efficient CHF bond portfolios. Foreign debtors play a considerably large role here. They allow a broader diversification of portfolio risks (countries, sectors and credit rating segments). In addition, CHF bonds from the foreign segment have a higher interest rate on average than their domestic counterparts. The yield advantage compensates for the somewhat weaker credit rating profile.

Attractive returns from foreign debtors

The Swiss Bond Index AAA-BBB in brief

The Swiss Bond Index (SBI) AAA-BBB is considered the standard benchmark in the CHF bond market. It shows the price performance of around 1,600 bonds. This covers a large proportion of the CHF bond market traded on the exchange. In order to be included in the index, these bonds must have a minimum maturity of one year and an issue volume of at least CHF 100 million. Moreover, they must satisfy a minimum rating of BBB (investment grade).

Issuers benefit from being included in the index. Investors are often only permitted to invest in index positions. If the bond is included in the index, this increases liquidity, as bonds can be traded by a larger number of investors. This also simplifies the placement of the bond and generally allows for a better new issue price for the issuer.