Senior secured loans convey deceptive security

Senior secured loans are highly valued by investors as they promise good performance in periods of rising interest rates. However, a look behind the scenes reveals a little-noticed risk.

The senior secured loans investment segment, also known as leveraged loans, has recorded inflows of around USD 12 billion since the beginning of the year. Senior secured loans are securitised loans to highly indebted US companies, the coupon payments of which are linked to a short-term, variable interest rate. With rising interest rates, investors can therefore enjoy higher coupon payments and do not have to fear any direct negative performance effects.

Interest rate risk through the back door

Nonetheless, the term "secured loans" is a tricky one. Technically speaking, these are senior and secured debts. But debtors typically have a very weak balance sheet. Against this background, the designation "leverage loans" would be more appropriate, even if this does not change the risks.

In our view, leveraged loans are significantly more affected by the second-order effects of rising interest rates than corporate bonds.

Much lower credit quality

Unlike companies with strong credit ratings in the investment-grade segment, leveraged loan issuers typically do not have access to simple credit lines and bank loans. Due to their weak creditworthiness, they are often even denied refinancing by means of high-yield bonds. For example, the proportion of issuers with a low B rating in leveraged loans has increased over the past ten years from around 50% to 70%, while in the high-yield segment it has fallen from 50% to 40%.

Difficult macro environment

Due to their small size and weak balance sheets, leveraged loan issuers have little pricing power. In the current environment, with very high cost increases, this fact is likely to have a negative impact on margins and therefore also profit. Economic growth is also weaker, which will have a negative impact on revenues. In addition, the sharp rise in interest rates will be reflected directly in the income statement in the form of higher interest costs. For debtors, the negative combination of high inflation, weaker growth and high interest rates represents a major challenge.

Weakest link of the US economy?

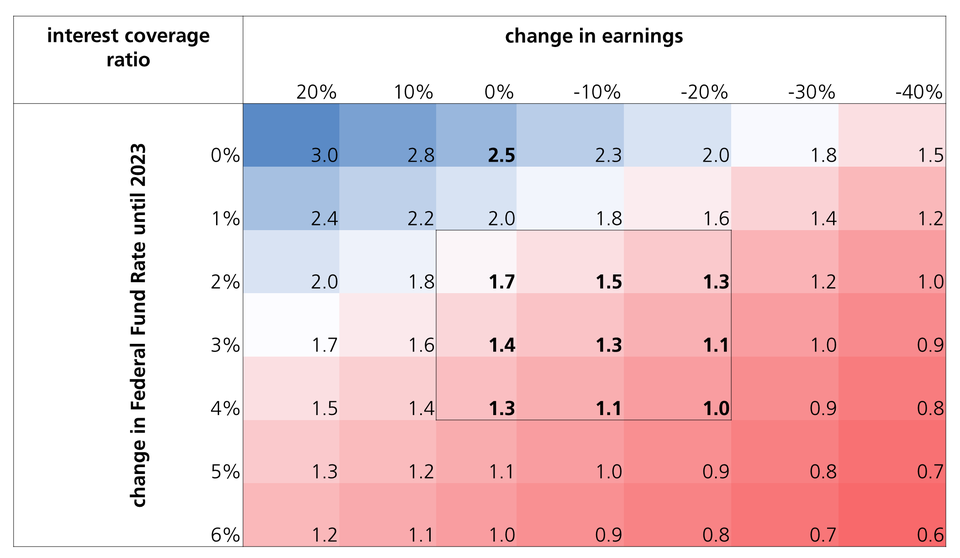

According to our scenario analysis, the expected increase in US key interest rates to 3% by mid-2023 could lead to a decline in the average interest coverage ratio* from 2.5x to a weak 1.4x. With an additional decline in profits of 20%, the interest coverage ratio would deteriorate further towards 1.0x – from this threshold, a company would no longer be able to make its interest payments from its operating business. In this scenario, the rating downgrades and defaults among leveraged loan issuers would probably increase significantly.

In this respect, the variable interest rate structure of leveraged loans could turn out to be the worst link of the US economy in the medium term – with corresponding disadvantages for investors.

Development of the interest coverage ratio depending on interest and earnings

*The interest coverage ratio compares earnings with interest expenses. This makes it possible to estimate how much profit a company needs to use to meet interest payments on its obligations. An interest coverage ratio of less than 1.0x means that the company can no longer make interest payments for loans from its operating business.