Fully electric in the fast lane

The greater range and, of course, the sharp rise in fuel prices are making electric vehicles attractive. Automotive manufacturers are investing heavily here.

Text: Manuel Renz and Daniel Fauser

Sales and the demand for all-electric vehicles (battery electric vehicles, BEVs) have increased significantly, especially since the coronavirus pandemic. While the share of new BEV registrations in Switzerland was 8.3% in 2020, it increased to 13.8% in 2021. What's more, the marked increase in prices for fossil fuels is likely to further boost demand for electric cars.

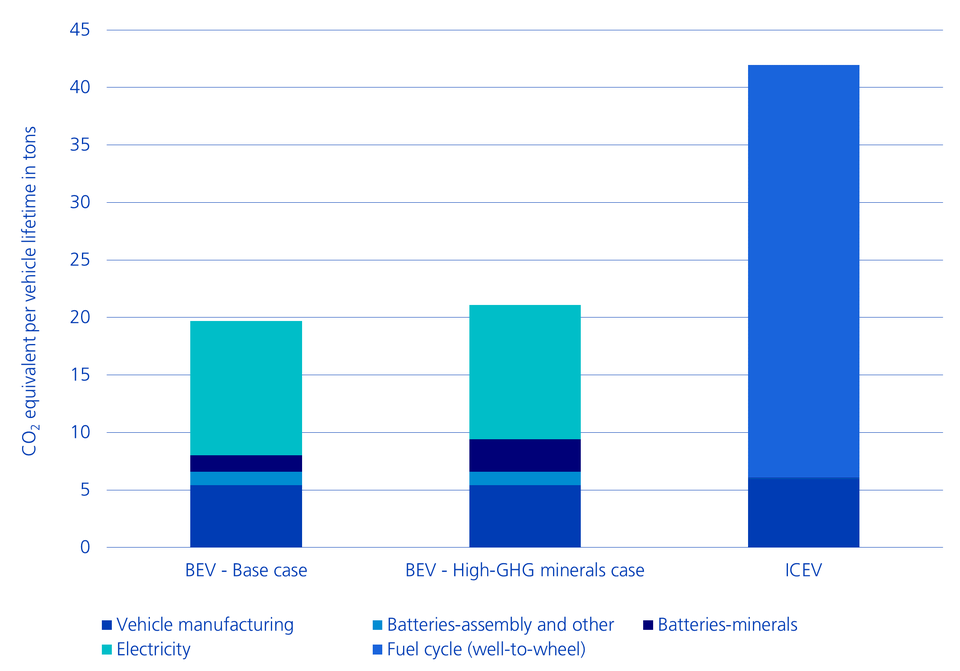

The trend towards electric vehicles will continue, partly because politics and society are striving to decarbonise the global economy. Conventional internal combustion engine vehicles (ICEVs), which still accounted for around 93% of global passenger car sales in 2021, emit lifecycle emissions of 42 tonnes of CO2 equivalents according to the International Energy Agency (IEA). In comparison, BEVs emit about half as many tonnes of CO2 equivalents. The graph below shows a global average value for the carbon intensity of the power grid. If electricity is obtained from sustainable sources for refuelling, the lifecycle emissions of BEVs are further reduced.

Lifecycle emissions comparison of BEVs vs. ICEVs

Consequential transition in production

The automotive industry has invested more than 100 years in the development and improvement of powertrain manufacturing and vehicle assembly. Converting production to BEVs will have a significant impact on the value chain of original equipment manufacturers (OEMs). This can be seen, for example, in the number of moving engine parts. According to a study by consulting firm PWC, the electric motor of a Chevrolet Bolt has just three moving parts. An ordinary combustion engine consists of around 113 moving components.

The transition to BEV production creates new approaches for the OEM value chain. Traditional OEMs have assumed the design, manufacture, assembly, marketing and aftersales of ICEVs. Tesla takes a completely different approach to the value chain and tries to be as vertically integrated as possible. In addition to the traditional OEM value chain, Tesla's value chain also includes the mining or extraction of raw materials required for batteries, for example, the refining and processing of microchips, the programming of software and a network of rapid charging stations for BEVs. As a result, traditional OEMs have opportunities to expand business, even if this involves major investments.

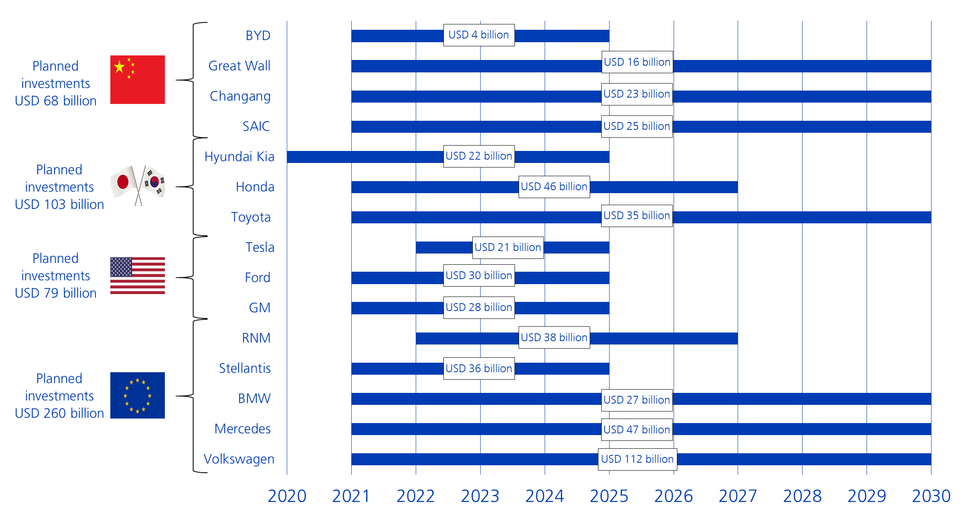

Big investments and even bigger strategies for BEVs

The following chart illustrates the current EV and battery investment commitments of OEMs. The investments presented are aimed at improving the range and performance of batteries, reducing the costs of electric vehicles and expanding the production of batteries and electric vehicles worldwide. The investments do not include those in additional production capacities of battery companies in which the OEMs are often involved as joint venture partners.

Estimated investments by various automotive manufacturers

Moreover, automotive manufacturers are outperforming each other with ambitious sales and model targets. Among other things, Volkswagen is aiming for a BEV share of 25% in relation to all vehicles sold in 2025 (currently around 5%). Ford is taking an even more aggressive approach by phasing out ICEV sales in Europe from 2026 and presenting 40 new BEV models for this year.

Overall, automotive analysts expect BEVs to grow annually in the range of 25% to 30% by 2030. Large and well-known OEMs such as Mercedes-Benz Group AG, Volkswagen AG, Ford Motor Co. and General Motors Co. will also benefit in spite of major investments.

Legal notice: The publications were prepared by the Buy-Side Research of the Asset Management of Zürcher Kantonalbank. The information contained in this document has not been prepared in accordance with any legislation promoting the independence of financial research, nor is it subject to any prohibition on trading following the dissemination of financial research.