Will inflation spoil Black Friday?

The «Super Shopping Month» has started with Singles Day. Forecasts indicate a mixed Black Friday and Cyber Monday. High inflation is also dulling the desire to buy. Nevertheless, there are investment opportunities.

Text: Manuel Renz

November with its Singles Day (11th), Black Friday (25th) and Cyber Monday (28th) is considered the "Super Shopping Month" of the year. The sales figures for these shopping days show how dazzling Christmas sales will be for retailers. The first event was Singles Day, which originated in China and is dedicated to single people on 11 November. The date, comprising only ones, is symbolic of single people.

Singles Day seems to be stalling. An indication of this comes from the Chinese retailer Alibaba. For the first time since the start of Singles Day in 2009, it did not disclose any revenues. The retailer only announced that the sales of the 11-day shopping event were at the previous year's level (sales in 2021: CNY 540 billion, around CHF 72 billion). Other Chinese retail giants such as Tmall or JD recorded flat to slight growth. However, this is significantly below the previous year's level. What's more, demand for consumer staples like food, household goods and personal care products exceeds that of cyclical consumer goods (such as watches and apparel). Consumers are therefore focusing on essential goods, which may be interpreted as a sign of consumer weakness.

Inflation is eating away at sales growth

The National Retail Federation (NRF), the world's largest retail trade association, provides information on how big shopping appetites could be. The association predicts sales growth of around 6% to 8%. This is significantly less than in 2021 at 13.5%. Although the expected sales growth is above the long-term average of 4.9%, the forecast does not take into account the high inflation in the US. This is hampering sales growth. According to the NRF, households are likely to spend an average of 833 dollars on gifts, decorations, groceries and other Christmas-related purchases, which is the average for the past decade. Taking inflation into account, however, Christmas-related expenditure is declining by almost USD 70 or -8.4%.

Significantly fewer seasonal workers in the retail sector in the US

The Association of US Retailers and Online Retailers is also sceptical. It expects retailers to hire between 450,000 and 600,000 seasonal workers in the US. For comparison: in 2021, almost 670,000 seasonal employees were taken on. This is equivalent to a decline of -10.4% to -32.8%.

Number of dedicated seasonal staff of individual US retailers since 2019

Strikingly, the comparison with 2019, the Christmas before the pandemic, shows that some retailers are also below this hiring level.

Retailer stock levels are full

One effect of the Covid-19 pandemic and the raging inflation are the currently high stock levels of retailers. As a rule, they place their orders six to twelve months in advance. Since high consumer demand in 2020 and 2021 was difficult to meet due to coronavirus-related supply chain bottlenecks, many retailers have placed larger and/or accelerated orders. The crux here is that with rising housing and food prices, consumers are currently demanding fewer household goods and other cyclical consumer goods. Consequently, stock levels remain high, but need to be drastically reduced for the upcoming Christmas sales business.

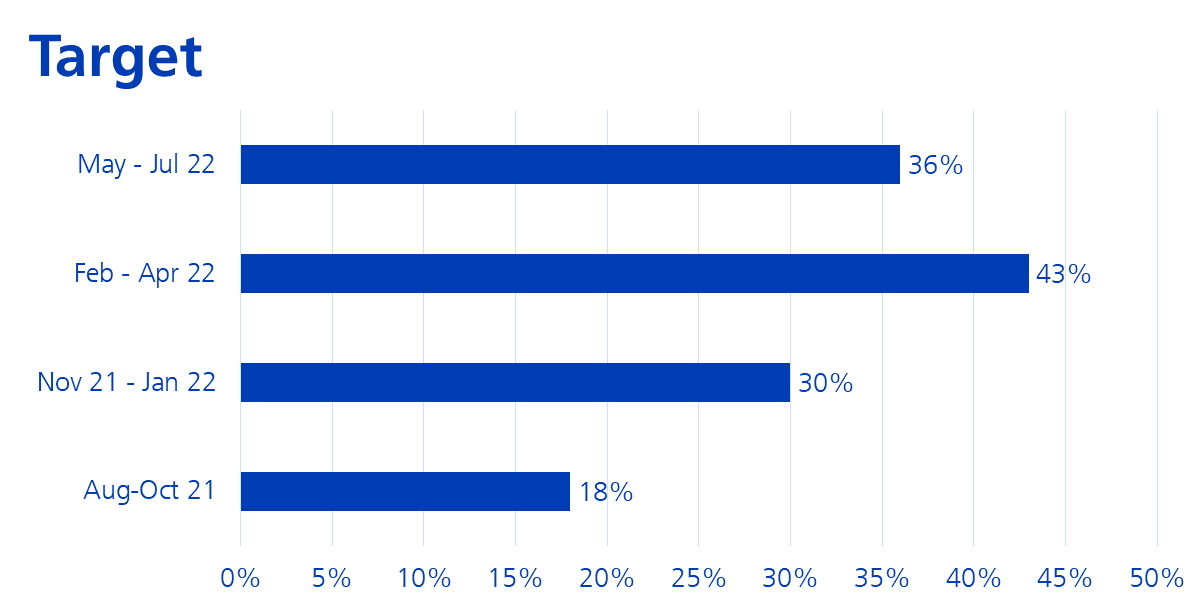

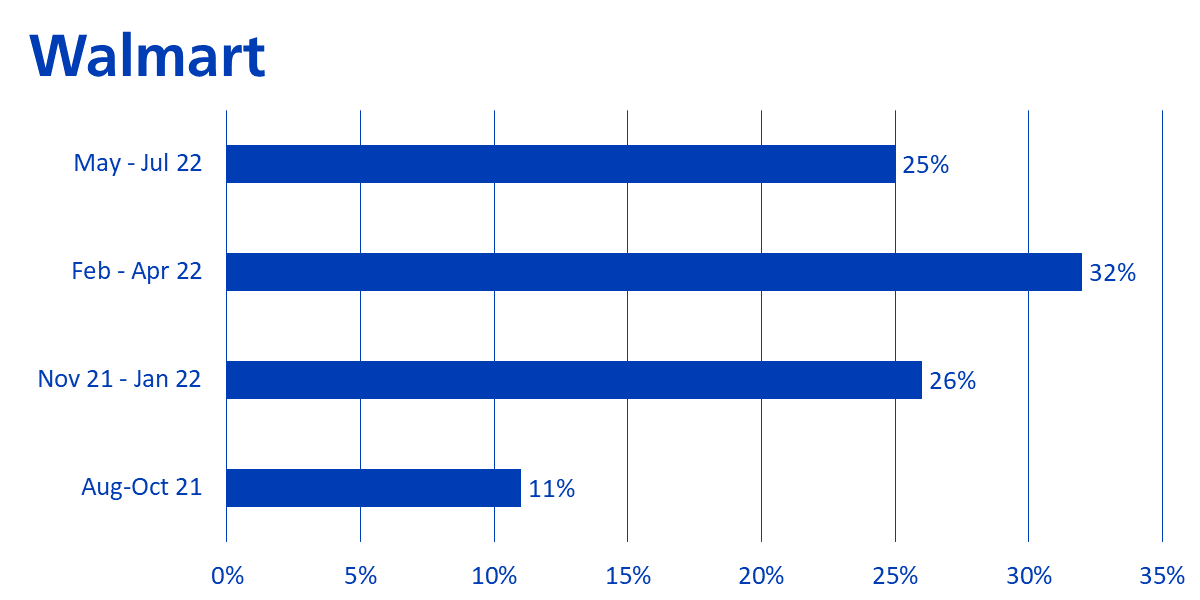

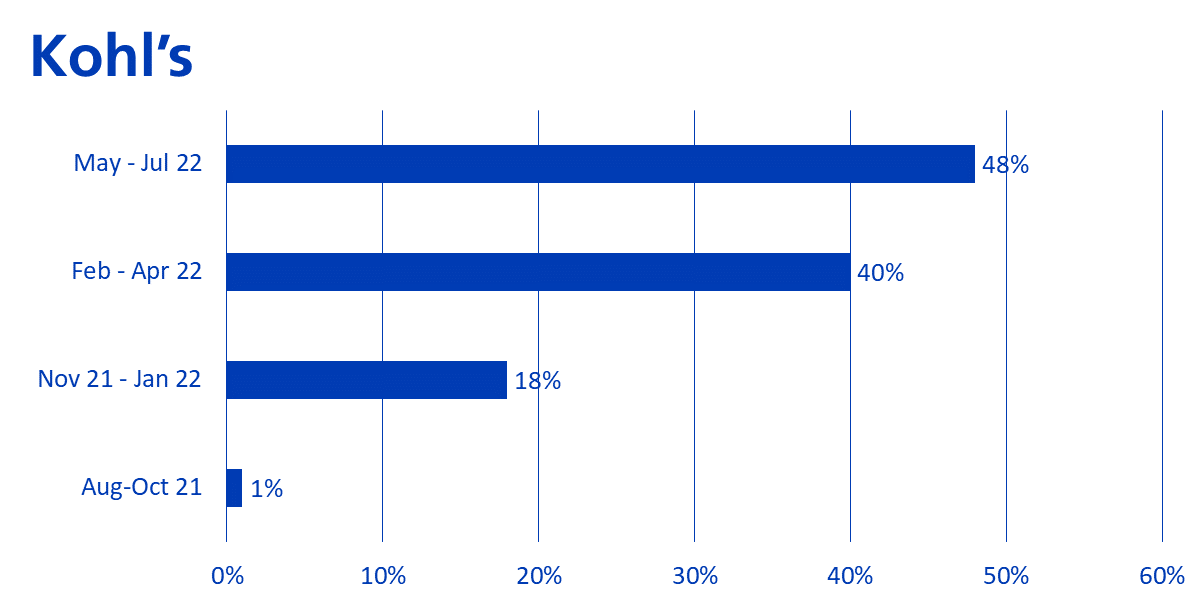

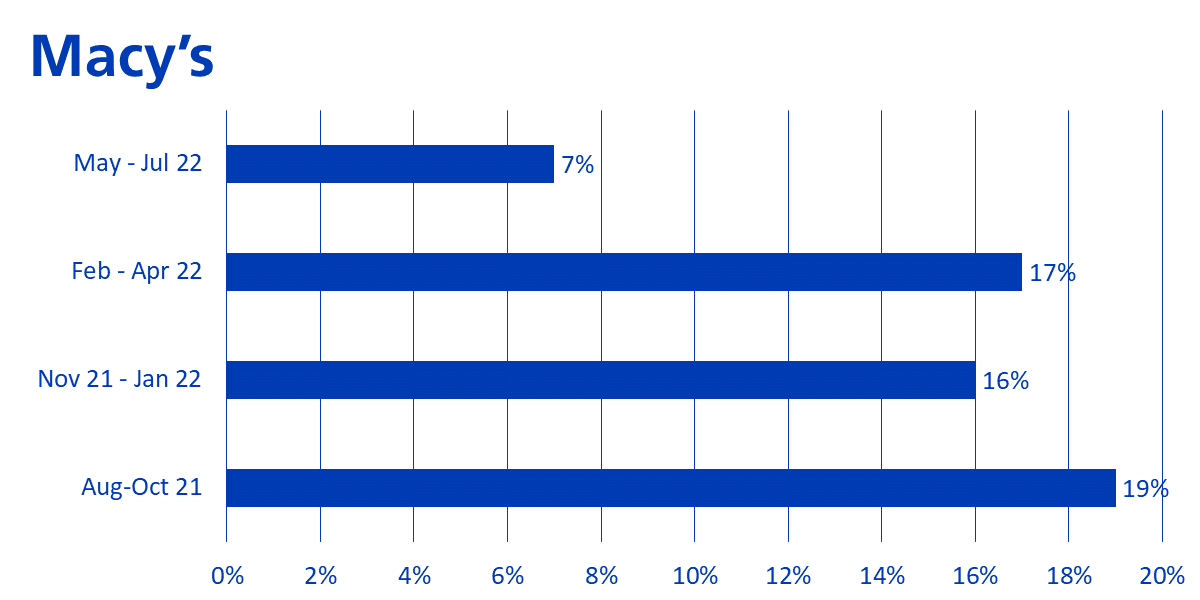

Inventories of individual retailers

For consumers, inventory reductions could mean bigger bargains. For retailers, however, this means their margins will shrink.

Investment opportunities still exist

However, the current market situation also offers some investment opportunities, particularly in connection with basic consumption. As explained above, demand is currently focused on food, household goods and personal care products.

| 2yr Forward ROIC | Enterprise Value / Invested Capital | ZKB ESG Score (A - G) |

|

|---|---|---|---|

| United Natural Foods | 8,1 % | 1,1x | A |

| Loblaw Companies | 10,5 % | 1,7x | B |

| 2yr Forward ROIC | Enterprise Value / Invested Capital | ZKB ESG Score (A - G) |

|

|---|---|---|---|

| Danone | 7,9 % | 1,3x | B |

| Strauss Group | 16,0 % | 2,3x | A |

| Saputo | 9,1 % | 1,6x | A |

| 2yr Forward ROIC | Enterprise Value / Invested Capital | ZKB ESG Score (A - G) |

|

|---|---|---|---|

| Reckitt Benckiser | 14,3 % | 2,4x | A |

| Henkel | 8,5 % | 1,3x | B |

The securities in the table were selected according to our quality analysis. Among other things, this takes into account the business model and the associated prospect of an attractive total return on invested capital (ROIC).

The less packaging, the better

In addition, securities were selected that have a score of at least B in the ESG rating of Zürcher Kantonalbank’s Asset Management. All of the companies presented are active in packaging and waste-intensive industries, which is why a detailed analysis of the reduction targets and strategy has been carried out. The companies mentioned have formulated clear reduction targets for waste, packaging and plastics used.

Legal notice: The publications were prepared by the Buy-Side Research of the Asset Management of Zürcher Kantonalbank. The information contained in this document has not been prepared in accordance with any legislation promoting the independence of financial research, nor is it subject to any prohibition on trading following the dissemination of financial research.