Plastic creates tailwind

More and more companies are likely to make investments in the circular economy, driven, among other things, by changing consumer behaviour and new regulations. The market research firm Gartner predicts, for example, that around 60% of global companies will achieve profitable growth through circular supply chains by 2026. Currently, such investments account for just 3% of expenditure in the – still linear – economy. But the race to catch up has begun, and politicians are providing some substantial help in many instances. For example, France is promoting the repair of products by law. Electrical devices must be marked with a repair index, showing consumers how easy it is to repair a product. In addition, the state will pay a repair bonus of up to several dozen euros.

How the circular economy becomes investable

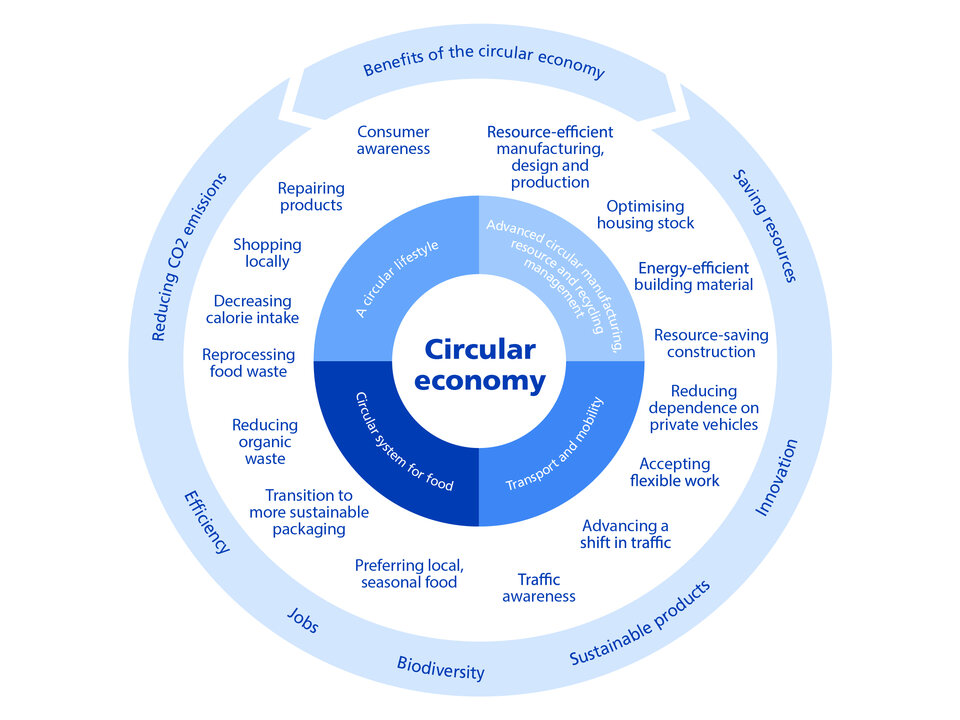

We have used the principle of the four Rs as the basis for compiling an investment universe. This spectrum includes numerous sub-topics from the areas of plastic or bio-recycling, product design and lifespan, higher efficiency in the production process and leasing business models (see chart below). We have also defined three categories of companies for our investment approach: solution providers who offer products and services that address the challenges of the circular economy. Plus, enablers who provide tools, software and technology to promote the circular economy. And finally, the leading users who actively promote the circular economy initiatives, integrate the processes and invest in them.