Interest rate cuts are fertile ground for gold

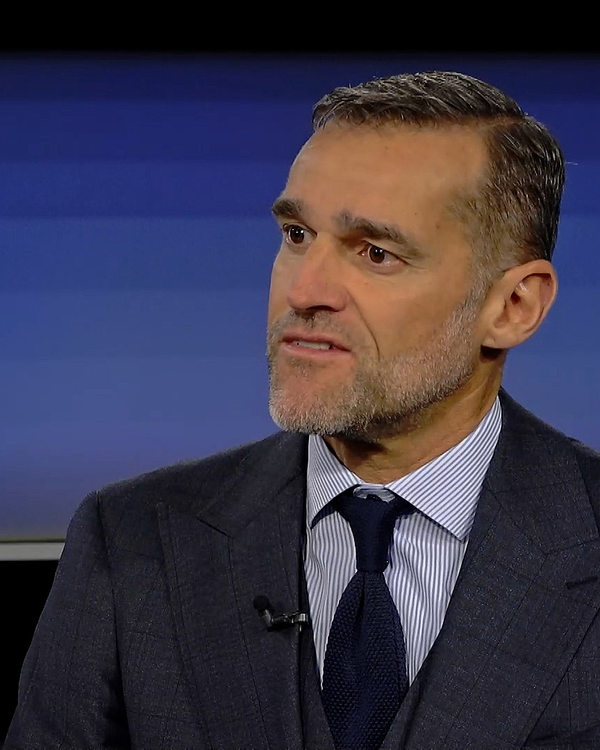

Due to interest rates and geopolitical uncertainties, Iwan Deplazes expects the price of gold to continue to perform well. However, the Head of Asset Management at Zürcher Kantonalbank is more cautious when it comes to silver.

Interview with Iwan Deplazes

Martin Spieler: Gold is seen by many as a safe haven and crisis currency. But how safe is the yellow metal really from an investor's point of view?

Iwan: Gold is indeed considered a crisis currency. This effect can be observed again this year - gold has increased in value by over 20 per cent since January and is trading at around CHF 70,000 per kilogramme. This shows how gold is in demand as a safe haven asset, especially in times of geopolitical uncertainty. But there are also phases in between, when the precious metal can be subject to very high fluctuations.

The gold price is also influenced by key interest rates and currencies, particularly the USD exchange rate. Is the current loose monetary policy with a downward trend in interest rates favourable for the future development of gold?

That is indeed the case. This is a good starting point for gold. Quite simply because, unlike stocks and bonds, it pays no interest or dividends. This means that the opportunity cost of holding gold is relatively high. But they fall the lower interest rates are.

Gold has reached record highs this year. Will the gold price continue to climb in the coming months?

We expect gold to continue to perform well due to geopolitical uncertainties in the Middle East and the conflict between Ukraine and Russia. On the other hand, we are somewhat more cautious about silver. This is because it is also used primarily in industry. If we were to see a slowdown in the global economy, this would have an impact on the price of silver.

Gold and silver pay neither interest nor dividends. So how worthwhile are precious metals as an investment?

Investing in precious metals alone is certainly not a good strategy - precisely for the reasons mentioned above. However, precious metals can be very valuable as a diversification to equities and bonds. For example, gold can prove to be a robust asset if the prices of securities come under pressure in the event of a countermovement on the markets.

Investors can also invest in other precious metals: in platinum or palladium, or in industrial metals such as copper. How interesting is this?

Palladium and platinum are also heavily used in industry. Accordingly, their price depends on the intensity of use and the share price performance of companies in those sectors. Copper, on the other hand, plays an important role in the decarbonisation of the economy. Nevertheless, I must warn that all three metals are subject to strong fluctuations.

What is the best way to invest in precious metals? Should investors buy gold coins - or are other instruments preferable?

Holding precious metals physically is one option. However, you should bear in mind that the sale of bars or coins such as the "Goldvreneli" incurs substantial commissions. It is more efficient and effective to invest in an exchange-traded index fund, a so-called ETF.

This interview was first broadcast in a slightly modified form in the broadcast "Geld" on Tele 1, Tele M1 and TVO on 6 September 2024. (Video available in Swiss German only).