Investing in gold: many roads lead to Rome

If you want to invest in gold, this raises the question of how this can best be implemented. Whether the need for security, diversification or the prospect of price increases is the deciding factor – there are different ways to invest in gold and participate in the price development of the yellow precious metal. We explain the five most important investment possibilities.

Overview: How can you buy gold?

- Physical

- ETF (exchange-traded fund)

- ETC (exchange-traded commodity)

- XAU currency

- Futures

The choice of one or the other investment variant depends on the individual scope and needs of the investor.

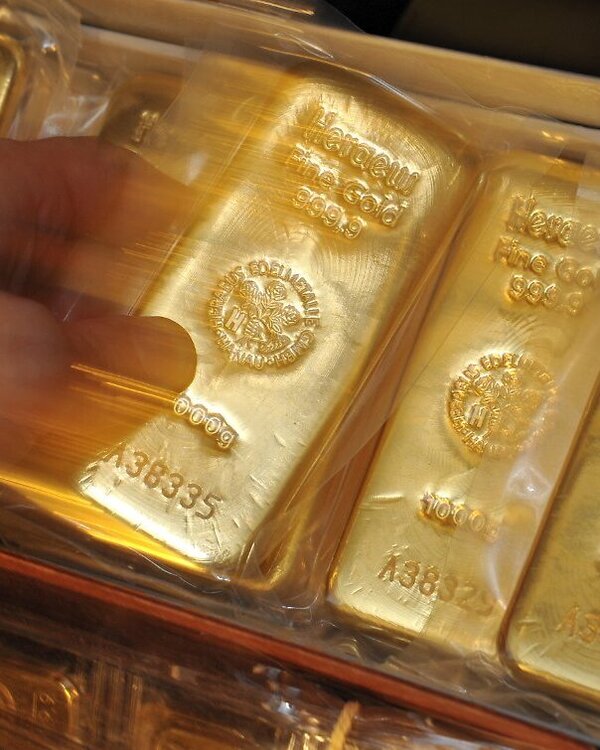

Physical: the classic way to invest in gold

The classic way to invest in gold is to purchase the precious metal directly. The quantities available range from 1 gram to 5, 10, 100 and 1,000 grams, up to standard bars of 400 ounces (12.44 kg). For investment purposes, in Switzerland ingots are usually traded from a size of 100 grams, and especially 1 kg bars. Some established gold coins, such as the South African Krügerrand, American Eagle or Australian Nugget, are also common due to their standard weight of 1 ounce. Banks set a daily price for these gold coins. Goldvreneli are less suitable for investment purposes, but may be of interest to collectors. The following should be kept in mind for all gold coins and bars: the larger the denomination, the smaller the premium that has to be paid on the actual gold value when purchasing. The table provides an indication of the difference between the purchase price and the sale price:

|

Purchase price in CHF |

Sale price |

Difference in % |

Gold bar, 1000 g |

51,973.45 |

52,344.95 |

0.7% |

Gold bar, 100 g |

5,181.85 |

5,265.50 |

1.6% |

Gold bar, 20 g |

1,036.35 |

1,058.10 |

2.1% |

Fairtrade gold, 1 g |

53.05 |

64.40 |

21.4% |

Krueger, 1 oz |

1,607.00 |

1,731.00 |

7.7% |

Maple Leaf, 1 oz |

1,607.00 |

1,731.00 |

7.7% |

Australian Nugget, 1 oz |

1,607.00 |

1,731.00 |

7.7% |

20 Vreneli |

289.00 |

334.00 |

15.6% |

Source: www.zkb.ch, as of 12/02/2021

When it comes to holding physical gold, it's important to remember that coins or bars purchased need to be stored at home or in a safe deposit box – with the associated risks (at home) or costs (for a deposit box or safe).

Exchange-traded funds (ETFs): gold in the form of an exchange-traded fund

The disadvantages of holding physical gold can be elegantly avoided with gold ETFs. Gold ETFs are exchange-traded investment funds that (often) have physically deposited the precious metal and reflect the price development of gold one-to-one. In Switzerland, gold ETFs benefit from a special statutory regulation. Although collective investment schemes and ETFs are usually required by law to have a minimum diversification of investments in investment funds, gold ETFs and gold index funds were authorised in Switzerland in 2006 as funds with only one product. As a result of this legal decision, gold ETFs in Switzerland are able to look back on a real success story.

Advantages and disadvantages of gold ETFs

- Gold ETFs are legally independent collective investment schemes under the Collective Investment Schemes Act. As with any other fund, the assets of the investment vehicle are therefore independent of the assets of the issuing bank. In the event of the issuer's insolvency, the assets of the ETF are not included in the bankruptcy assets.

- Another advantage is the low price difference when buying and selling the ETF compared to the physical purchase of coins and bars.

- The annual ETF fees for administration, storage and insurance are low compared to the costs and risks of physical storage.

- Although delivery of the precious metal is generally possible, physical delivery is expensive.

Exchange-traded commodity (ETC): gold in the form of a debt security

Since gold is not permitted in the form of an investment fund outside the USA and Switzerland, banks elsewhere use gold products in the form of debt instruments known as ETCs. These products also reflect the price development of gold, but are not treated as special assets in the event of the bankruptcy of the issuer.

XAU currency: trading gold on the foreign exchange market

Gold can be held in a metal account as a precious metal balance (XAU). The high liquidity of the foreign exchange market enables fast and cost-effective transactions between the precious metal and other currencies. In principle, it is possible to convert the credit balance into physical metal, but this entails costs.

Futures: trading gold on the futures market

Experienced investors in particular speculate on rising or falling prices on the futures market via gold futures. This has the advantage that standardised contracts enable efficient trading. The transaction costs of gold futures are low. A fixed price is determined by contract on fixed dates on which the gold is bought or delivered. However, most of these futures market transactions do not result in physical delivery, but end with the closing of the positions entered into during the term of the contract – often shortly before the delivery date. Since futures contracts have an expiry date, they need to be rolled periodically if the position is to be maintained.

The volume of «paper gold» traded is far higher than the volume of physical gold actually available due to the low capital required in trading. This can lead to periods of turbulence, as was the case in March 2020. The coronavirus-related lockdowns in many countries resulted in gold refineries also having to suspend their work. Concerns about the future physical availability of the precious metal led to a sharp rise in the prices of futures contracts with short maturities. Futures prices for gold contracts maturing in the near future were higher than prices for later deliveries. Investors who wanted to stock up on gold in the short term were therefore willing to pay a premium. This anomaly between futures prices and spot prices was exploited by arbitrage traders who sold futures accordingly and covered their positions cheaply on the spot market. This example demonstrates that the price between different gold vehicles can drift apart in the short term.

The five investment possibilities in gold at a glance

|

Physical |

ETFs |

ETCs |

XAU currency |

Futures |

Vehicle |

Bars, coins |

Investment funds |

Debt instruments |

Metal accounts |

Gold futures |

Premium/spread (excl. stamp duty/commission)* |

0.20%-20% |

0.05%-0.20% |

0.05%-0.20% |

0.03%-1.00% |

0.01%-0.02% |

Administration fees p.a.* |

storage and insurance costs |

0.20%-0.40% |

0.15%-0.25% |

0.10%-0.50% |

- |

Suitable for private investors |

Yes |

Yes |

Yes |

Yes |

No |

Counterparty risk |

No |

No |

Yes |

Yes |

No |

Physical delivery possible |

- |

Yes |

Yes (limited) |

Yes (limited) |

Yes |

*Consideration of the institutional and retail segment

Source: Zürcher Kantonalbank / various