Swiss real estate funds: Invest after the price correction?

The prices of listed real estate funds fell sharply again in September 2022. What happened? Does the current price level offer an entry opportunity?

Text: Jan Elmer

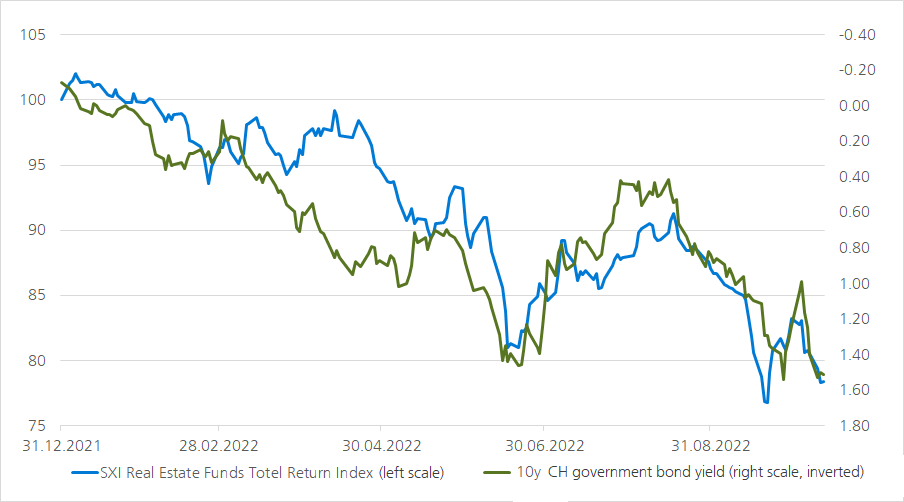

The chart shows what has transpired at a glance: the price development of listed real estate funds is highly synchronised with the development of long-term interest rates. To illustrate this, we have inverted the right-hand scale of the chart below, which shows the yield of the 10-year Swiss Confederation bond.

Index of real estate funds and yield of the Confederation bond: high correlation

In the course of the slight decline in longer-term interest rates from the end of June to mid-August of this year, stock market prices and also the premiums of listed Swiss real estate funds recovered somewhat. However, longer-term interest rates have risen again since mid-August due to persistently high inflationary pressure. To counteract the high inflation, the Swiss National Bank raised the key interest rate to 0.5% in September. As a result, the prices and premiums of listed real estate funds came under severe pressure once again.

How can this market movement be seen in a longer-term context?

On 5 January 2022, the index of listed Swiss real estate funds (SWIIT index) reached a new all-time high at 529.47. By 21 September 2022, the index lost nearly 25%, the largest loss since the launch of the SWIIT index. For comparison: following the outbreak of the coronavirus crisis in 2020, the SWIIT index suffered a loss of almost 20%.

The decline in premiums could also be the anticipation of an impending or already initiated devaluation on the real estate market. How should this situation be viewed?

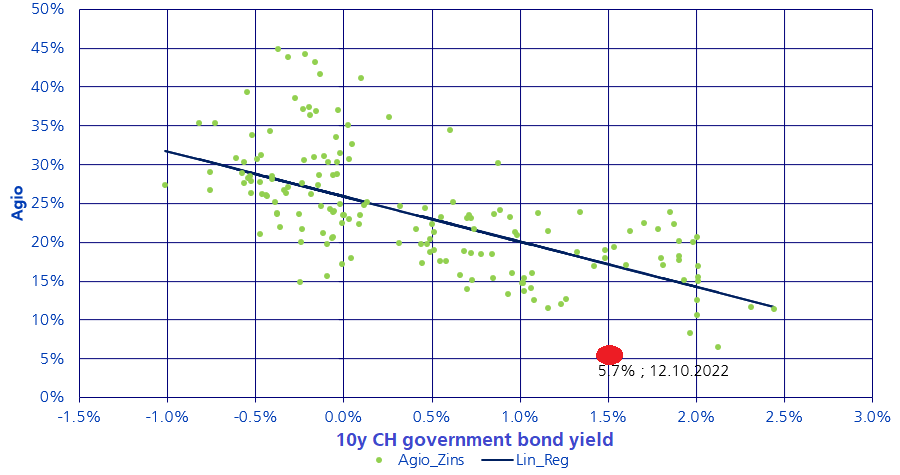

Future expectations are traded on the stock markets. In this respect, the stock exchange is already anticipating certain developments on the real estate market. Looking at the historical ratio of average premiums and long-term interest rates, it is noticeable that at the current interest rate level (10-year Confederation bond yield: 1.5%), a higher premium was traded in the past. In other words, historically, the current average premium (5.7%) should be associated with a significantly higher interest rate level. Any devaluations of real estate would put this ratio into perspective, as the premium would automatically increase if market prices remained the same and real estate values remained lower. However, according to our information, the transaction market remains liquid and prices paid remain high. In the short term, this does not indicate any large-scale devaluations in the real estate segment. Today, we expect the transaction market to cool slightly.

Premiums are too low when compared historically

When will the reference rate increase due to the increased mortgage rates? Wouldn't this be positive for future rental income for residential landlords?

Our real estate specialists expect the benchmark interest rate to rise from 1.25% to 1.50% in the first half of 2023. Such an increase of 0.25% usually leads to rent increases of approx. 3%. In addition, the current high immigration and lower construction activity point towards higher quoted rents. The solid and thus generally growing cash flows in the residential real estate segment therefore cushion the valuation risks somewhat.

Are the profits of real estate funds melting away due to the increased financing costs?

The regulator prescribes a maximum external debt ratio of 33% for Swiss real estate funds. Due to the conservative debt ratio, the increased financing costs have a rather limited influence on profits overall. If we compare various real estate funds with each other, however, there are large differences in financing. We are currently avoiding real estate funds that have a comparatively high level of external debt coupled with a short average remaining term of the mortgages. In individual cases, the resulting increase in financing costs could lead to a distribution reduction in the future.

Is now the time to invest after the price correction?

If we compare the average distribution yield of the listed Swiss real estate funds of currently approx. 2.95% with the yield on 10-year German government bonds with a current yield of around 1.5%, you still achieve a return surplus of almost 1.5%. Commercial real estate funds even have an average distribution yield of 3.6% currently, which we believe is extremely attractive. In addition, inflation protection in commercial leases offers potential for rent increases. As mentioned above, we currently see listed real estate funds as favourably valued. The premiums are too low for the current interest rate level in a historical comparison. However, should there be further interest rate rises, this entails risks for listed real estate vehicles – as the correlation of real estate fund prices and long-term interest rates clearly shows.