What Swiss "Wrestling" Has in Common with SMI Heavyweights

Swiss wrestling, called "Schwingen", a sport steeped in tradition in this country, is approaching its pinnacle: at the end of August, the ESAF will take place in the Glarus region. But what does this popular sport have to do with the Swiss Market Index (SMI)? More than one might initially think.

At the Eidgenössische Schwing- und Älplerfest (ESAF) from 29 to 31 August, only the strongest athletes – the so-called “Bösen” (the “bad guys”) – will compete for victory. Often, those who win are the ones who have technical skills as well as above-average physical weight. The latter is something wrestlers, called Schwinger, have in common with Switzerland’s corporate elite, represented by the Swiss Market Index (SMI). The benchmark index of the Swiss stock exchange includes the 20 largest publicly traded companies in Switzerland.

Among the dominant players in the SMI are Nestlé, Novartis, and Roche. Together, they boast a market capitalisation of around CHF 600 billion. For comparison, the total market capitalisation of the SMI is approximately CHF 1,300 billion. However, weight alone is no guarantee of success – whether in the sawdust ring or on the Swiss stock exchange.

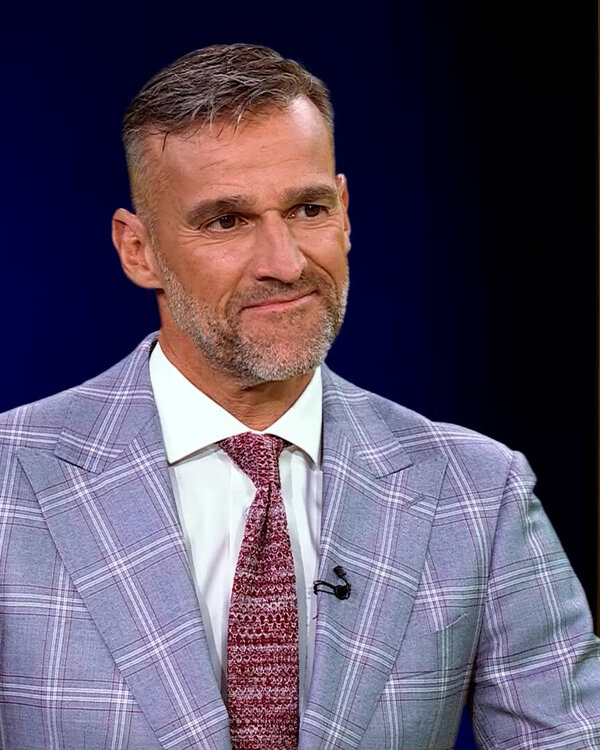

“In recent years, somewhat less heavyweight companies like ABB, Swiss Re, or Holcim have significantly outperformed the three SMI heavyweights,” explains Iwan Deplazes on the programme Geld & Vorsorge. This demonstrates that success depends not only on size and weight but also on other factors such as agility, strategy, the political environment, or market positioning.

Diversified Investing as the Key to Success

Just as in wrestling, where smaller, more agile athletes with the right technique and tactics can also compete at the top, diversification is crucial for achieving investment returns. A portfolio focused solely on SMI heavyweights can – as shown above – be outperformed by others. Therefore, it’s worth considering lighter SMI stocks (in terms of market capitalization) as well as small and medium-sized enterprises. The latter often offer exciting growth opportunities and can effectively diversify a portfolio.

For private investors who lack the resources or time to invest in all 20 SMI stocks as well as additional small- and mid-cap companies, funds can be a viable alternative. Through exchange-traded funds (ETFs), investors can achieve relatively low-cost diversification. Actively managed funds, on the other hand, aim to generate above-average returns through specific stock selection. There are also both active and passive funds that incorporate sustainability aspects into their investment strategies. As always, the choice of investment products should align with individual risk tolerance and capacity.

Home Bias vs. Global Diversification

Just as the ESAF is a celebration of Swiss traditions, many investors tend to focus primarily on domestic SMI stocks – a phenomenon known as home bias. However, when constructing a portfolio, it’s essential to look beyond national borders. International diversification can be crucial for benefiting from growth opportunities outside the Swiss stock exchange and spreading risk.

Incidentally, even at the ESAF, it’s not just Swiss wrestlers who are allowed to compete. A small delegation of foreign wrestlers also participates. A broadly diversified portfolio that includes both Swiss and international stocks offers the best chances for long-term success.

You should focus on companies that are global leaders and pursue a clear strategy.

Iwan Deplazes

Conclusion: Weight Isn’t Everything

Whether in the sawdust ring or on the Swiss stock exchange, weight alone is not enough to guarantee success. In both wrestling and investing, technique, strategy, and the ability to adapt to changing conditions are what truly count. For investors, this means not only focusing on the largest and most well-known SMI stocks but also considering small- and mid-cap companies as well as international markets. With a smart, diversified investment strategy and a long-term investment horizon, the chances of successful investing are high – much like a wrestler who secures the victory wreath with a mix of technique, strength, endurance, and strategy.

For additional information on the Swiss Market Index and diversified investing, watch the video (available only in Swiss German).

Legal Disclaimer

Legal Disclaimer

Legal Disclaimer Switzerland

This document only serves advertising and information purposes, is for distribution in Switzerland only and is not directed at persons in whose nationality or place of residence prohibit access to such information under applicable law. Where not indicated otherwise, the information concerns the collective investment schemes under the law of Luxembourg managed by Swisscanto Asset Management International S.A. (hereinafter "Swisscanto Funds"). The products described are undertakings for collective investment in transferable securities (UCITS) within the meaning of EU Directive 2009/65/EC, which is governed by Luxembourg law and subject to the supervision of the Luxembourg supervisory authority (CSSF). This document does not constitute a solicitation or invitation to subscribe or make an offer to purchase any securities, nor does it form the basis of any contract or obligation of any kind. The sole binding basis for the acquisition of Swisscanto Funds are the respective legal documents (management regulations, sales prospectuses and key information documents (PRIIP KID), as well as financial reports), which can be obtained free of charge at https://products.swisscanto.com as well as at Swisscanto Fondsleitung AG, Bahnhofstrasse 9, CH-8001 Zurich (also acting as representative of the Luxembourg Swisscanto funds in Switzerland) or in all offices of Zürcher Kantonalbank. Paying Agent for the Luxembourg Swisscanto funds in Switzerland is Zürcher Kantonalbank, Bahnhofstrasse 9, CH-8001 Zurich. Information about the sustainability-relevant aspects in accordance with the Regulation (EU) 2019/2088 as well as Swisscanto's strategy for the promotion of sustainability and the pursuit of sustainability goals in the fund investment process are available on the same website. The sub-fund referred to in the document is subject to Article 9 of Regulation (EU) 2019/2088. The distribution of the fund may be suspended at any time. Investors will be informed about the deregistration in due time. The investment involves risks, in particular those of fluctuations in value and earnings. Investments in foreign currencies are subject to exchange rate fluctuations. Past performance is neither an indicator nor a guarantee of future success. The risks are described in the sales prospectus and in the PRIIP KID. The information contained in this document has been compiled with the greatest care. Despite professional procedures, the correctness, completeness and topicality of the information cannot be guaranteed. Any liability for investments based on this document will be rejected. The document does not release the recipient from his or her own judgment. In particular, the recipient is recommended to check the information for compatibility with his or her personal circumstances as well as for legal, tax and other consequences, if necessary, with the help of an advisor. The prospectus and PRIIP KID should be read before making any final investment decision. The products and services described in this document are not available to U.S. persons under the relevant regulations (in particular Regulation S under the U.S. Securities Act of 1933).

Data as at (where not stated otherwise): 11.2024

© Zürcher Kantonalbank. All rights reserved.

Legal Disclaimer international

This document only serves advertising and information purposes and is not directed at persons in whose nationality or place of residence prohibit access to such information under applicable law. Where not indicated otherwise, the information concerns the collective investment schemes under the law of Luxembourg managed by Swisscanto Asset Management International S.A. (hereinafter "Swisscanto Funds"). The products described are undertakings for collective investment in transferable securities (UCITS) within the meaning of EU Directive 2009/65/EC, which is governed by Luxembourg law and subject to the supervision of the Luxembourg supervisory authority (CSSF).

This document does not constitute a solicitation or invitation to subscribe or make an offer to purchase any securities, nor does it form the basis of any contract or obligation of any kind. The sole binding basis for the acquisition of Swisscanto Funds are the respective published legal documents (management regulations, sales prospectuses and key information documents (PRIIP KID), as well as financial reports), which can be obtained free of charge at https://products.swisscanto.com/. Information about the sustainability-relevant aspects in accordance with the Regulation (EU) 2019/2088 as well as Swisscanto's strategy for the promotion of sustainability and the pursuit of sustainability goals in the fund investment process are available on the same website. The sub-fund referred to in the document is subject to Article 9 of Regulation (EU) 2019/2088.

The distribution of the fund may be suspended at any time. Investors will be informed about the deregistration in due time. The investment involves risks, in particular those of fluctuations in value and earnings. Investments in foreign currencies are subject to exchange rate fluctuations. Past performance is neither an indicator nor a guarantee of future success. The risks are described in the sales prospectus and in the PRIIP KID. The information contained in this document has been compiled with the greatest care. Despite professional procedures, the correctness, completeness and topicality of the information cannot be guaranteed. Any liability for investments based on this document will be rejected. The document does not release the recipient from his or her own judgment. In particular, the recipient is recommended to check the information for compatibility with his or her personal circumstances as well as for legal, tax and other consequences, if necessary, with the help of an advisor. The prospectus and PRIIP KID should be read before making any final investment decision.

An overview of investors' rights is available at https://www.swisscanto.com/int/en/legal/summary-of-investor-rights.html.

The products and services described in this document are not available to U.S. persons under the relevant regulations (in particular Regulation S under the U.S. Securities Act of 1933). Data as at (where not stated otherwise): 11.2024

© Zürcher Kantonalbank. All rights reserved.