Using renewable energy to mitigate rising inflation and supply insecurity

Europe is facing record fuel prices. Worse still, the security of our energy supply is in doubt. Fortunately, more and more countries are showing it is cheaper to generate electricity from newly installed solar and wind farms than from existing coal-fired and natural gas-fired power plants that have already reached the end of their economic life. Equities from the renewable energy sector can therefore be seen from a new perspective.

Text: Daniel Fauser and Dr Gerhard Wagner

Critical supply situation due to dependence on Russian energy

Europe’s energy security is at stake. Since the start of Russia's war of aggression against Ukraine, the situation on international energy markets has worsened significantly, especially in Germany and Italy. Due to the difficult situation, Germany has already dusted off the emergency plan for its gas supply and has already triggered the first two of the three escalation levels (early warning and alarm level). If the third and final escalation level of the plan is reached, gas rationing is likely to be brought in for certain industries.

Risk of recession if gas taps are turned off

In a joint analysis by Germany’s five leading economic research institutes, economists predict the German economy would suffer massive losses if gas supplies were disrupted in 2022 and 2023. Around EUR 220 billion, or 6.5% of German economic output, would be at risk. Even today, the effects of dependence on fossil fuels from Russia are considerable. For consumers, ever-increasing electricity and gas bills are becoming an increasing strain.

Renewables are relatively cheap

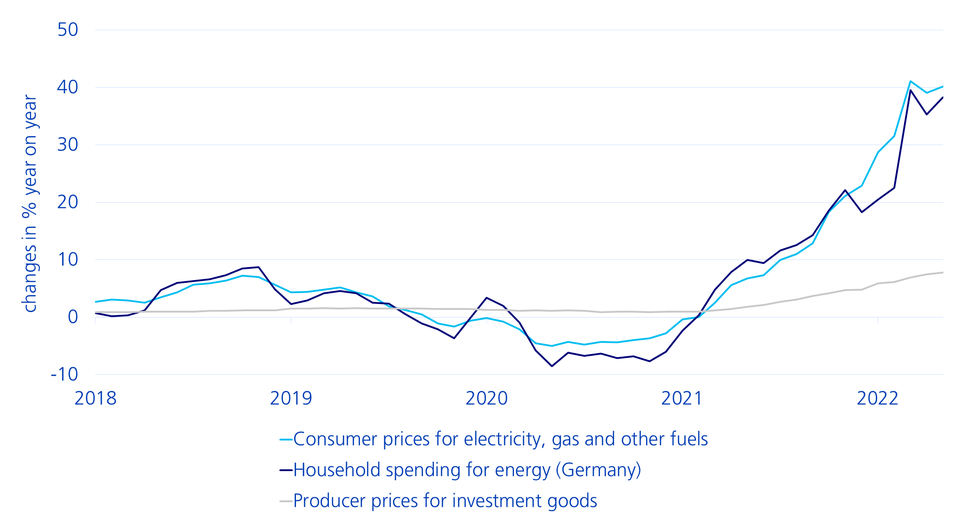

At the same time, inflation is now ubiquitous. Consumers in the European Union paid 40% more for electricity, gas and other fuels in May 2022 than in the same month last year. The prices of natural gas, coal and oil have soared as a result of the sanctions against Russia and the resulting shortages of fossil fuels. The prices of capital goods in the European Union, however, have only increased by a comparatively modest 8%. These large differences between the prices of fossil fuels and capital goods – including wind turbines, solar plants and heat pumps – have direct consequences for electricity generation.

Consumer and producer prices in the European Union since 2018

According to Bloomberg New Energy Finance, the massive increase in fuel prices has made it significantly cheaper to generate electricity with newly installed solar and wind farms than with existing coal and natural gas power plants. Not only does renewable energy reduce energy costs for the end user, the geopolitical advantage in terms of security of supply complements the economic advantage.

Costs of renewable energy

The cost advantage of renewables is particularly pronounced at the moment, but is nothing new. Since 2018, solar and wind energy have generally been the cheapest form of power generation for new investment. According to the latest figures from BNEF, this is already the case in countries which account for 90% of global electricity generation. The current surge in inflation is increasing the price advantage. But renewable energy producers are not immune from higher input prices either. Neverhteless, the increase in their electricity generation costs is moderate by comparison. While global photovoltaic prices have risen by an average of 3.7% this year, global price increases for gas-fired power plants are much higher at 9.2%. In Europe, the increase in the case of gas-fired power plants is as much as 20%.

Given this situation, there are a number of arguments in favour of renewable energies:

- The overwhelming dependence on Russian primary energy requires a change of strategy to ensure an independent energy supply.

- An essential part of this change in strategy is to promote local value-adding chains for cleaner technology.1

- Investments in gas and coal exploration are on the wane due to the climate problem. This could lead to higher fuel prices in the long term.

- CO2 prices are rising, further increasing the relative attractiveness of renewables.

Renewable energy for investors

As a fund provider, our sustainable Swisscanto investment funds in the area of renewable energy sources are focusing on companies with a dedicated CO2 reduction target. According to analyses, these companies will post above-average and profitable growth. When selecting stocks, we pay particular attention to quality, i.e. solid returns on capital, low debt, low ESG risks and an impressive track record of management performance. A very important factor is leadership in technology. Good examples of companies which meet these criteria are Denmark's Orsted, which is the global market leader in offshore wind power, Israel's SolarEdge, which optimises energy monitoring systems, and China's Contemporary Amperex Technology (CATL), which is the largest manufacturer of lithium-ion batteries. CATL announced an ambitious project on 14 August 2022. A battery factory with a capacity of 100 gigawatt hours per year is to be built in Hungary – with Mercedes the biggest customer.

1 For example, the recent Inflation Reduction Act package put together by the US Congress addresses this problem with batteries by requiring the majority of battery raw materials and components to be manufactured in the US for a manufacturer to qualify for tax credits.

Legal notice: The publications were prepared by the Buy-Side Research of the Asset Management of Zürcher Kantonalbank. The information contained in this document has not been prepared in accordance with any legislation promoting the independence of financial research, nor is it subject to any prohibition on trading following the dissemination of financial research.