Is devaluation for equity over? A bottom-up perspective

Rising inflation and interest rates have been affecting equities for several months. How can the journey continue and how can an equity portfolio be aligned? We attempt to provide answers to these and other questions.

Text: Diego D'Argenio and Rocchino Contangelo

At the beginning of this year, we pointed out that equity investors have become too complacent about market conditions, and that a new regime of monetary policy aimed at fighting inflation will have significant implications for equity valuation. What we warned about back then has now come to pass: Interest rates and inflation are going up, all stock indices worldwide have fallen. We are in a classic bear market.

Which sectors have suffered the most?

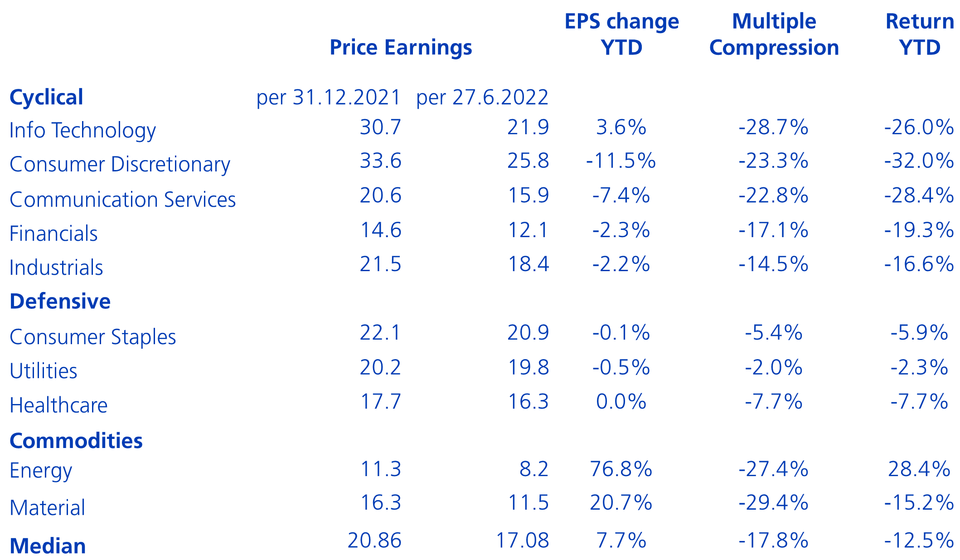

Since January, global equity valuation declined by approximately 21 % (MSCI World) from 20x P/E to 15x P/E. In drilling down the fundamental and valuation data and focussing on the US equity market (see table), we see that expensive stocks have suffered the largest contraction in valuation multiples; in particular, IT, consumer discretionary and communication services. For most of these stocks, the expected EPS has declined since the beginning of the year. But such a devaluation only partially explains the relative performance. Indeed, the main performance driver was a correction in valuation-multiple-compression, triggered by rising interest rates.

Interestingly, energy and materials stocks are still cheap relative to January’s level as result of the strong upward revisions in earnings and despite the large outperformance YTD.

Has the process of equity valuation-multiple contraction reached a bottom?

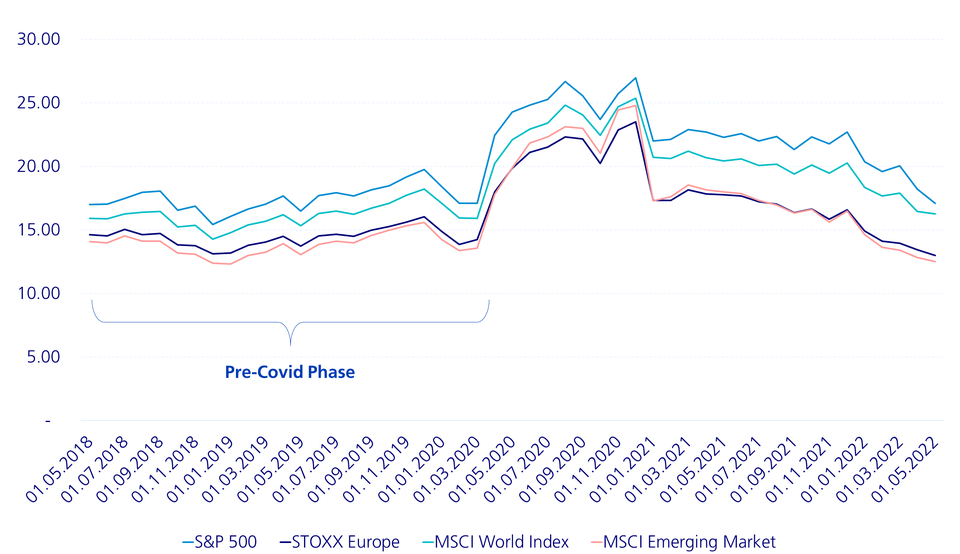

If we look at valuation multiples across several regions (see the chart below), we estimate that the re-pricing process is now almost finished as valuation is very close to the pre-Covid trading level.

Development of P/E ratio by region

However, if the market is viewed from a bottom-up perspective - taking into account the expected earnings growth of individual companies - we still see further potential for correction. The rapid rise in interest rates combined with rising inflation, in the US inflation climbed to 9.1 % in June 2022, is affecting corporate profitability; this is not yet fully priced in.

What about the impact of rising inflation?

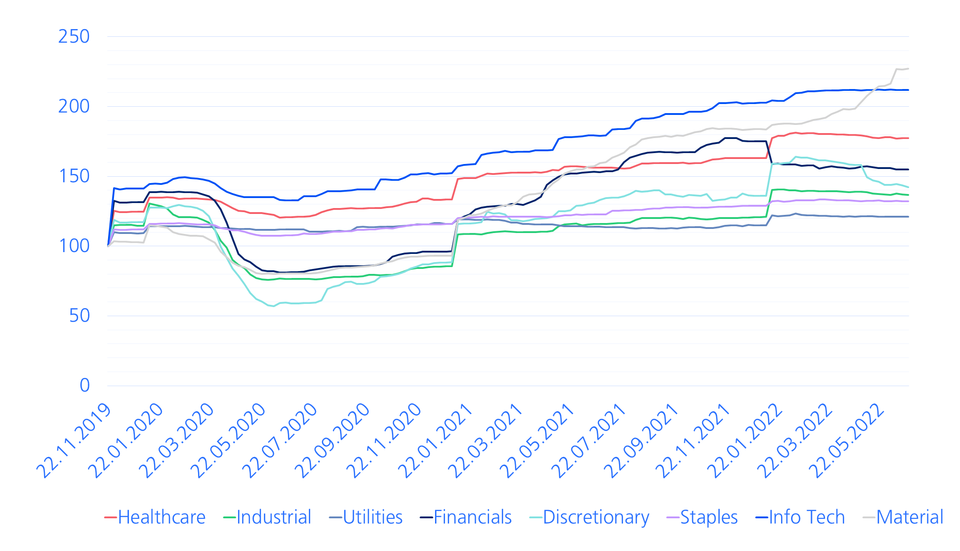

Headwinds, due to supply chain issues and rising inflation, have so far had only a modest impact on corporate earnings downgrades. As illustrated in the chart below, earning downgrades only started recently and particularly affected consumer stocks.

Development of earnings per share by sector (USA)

Sector indices, as of 2 June 2017 = 100, chart shows revisions of EPS since 22 November 2019

It is also evident from past trend readings that the earnings decline starts from a very high level, given that corporations’ earning growth in the US was very strong over the past five years. Companies also built up new capacity to keep up with increasing demand. The flip side of this trend is that the weakness in revenues from today’s level, based on the levelling off of demand, will see large implications for corporate profitability, given that the lower benefits in operating leverage as cost were built up recently. Evidence of lower profitability is already popping up among some large US names. Amazon, for example, has increased costs over the past few quarters and now feels pressure on earnings as a result of eCommerce activity slowing down.

What are the risks of further rising interest rates and inflation?

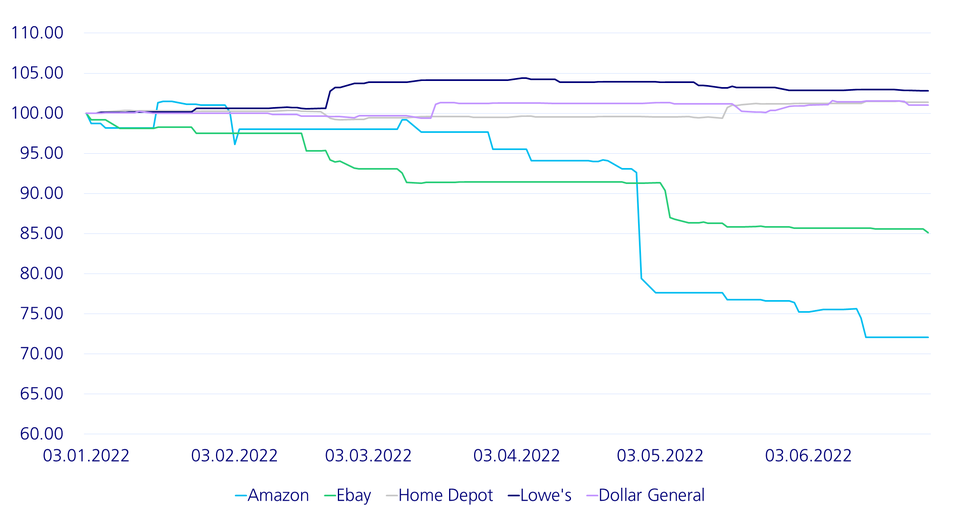

The chart below shows EPS trends for the largest US retailers. Until the present, we see that earnings downgrades among US retailers are still a company-specific story, but have the potential of spilling over to the rest of the market if inflation remains elevated and consumer demand is affected. Given the vulnerability in corporate earnings, further adjustment in equity valuation should be expected.

Development of earnings per share in US retail since the beginning of the year

Share prices indexed, 3 January 2022 = 100

How can an equity portfolio be aligned?

In this market environment, investors should put stock valuation at the forefront of the investment process. Stocks with attractive valuations should continue to benefit in this market’s environment. In addition, in the environment of rising interest rates and a slowdown of economic activity, investors should pay close attention to cash flow generation, balance sheet quality and high dividend paying companies.