Tackling greenwashing with transparency, standards and education

Greenwashing is the buzzword of the moment and is increasingly bringing all fund providers into disrepute. Greater transparency in the investment process and adequate advice may offer a remedy.

Text: Fabio Pellizzari

Customers who have been deceived will no longer trust even honest companies. All providers of sustainable funds are currently exposed to this risk, regardless of whether their marketing resources are sufficient or promise too much. Exaggerations by individual providers now pose a challenge to all. If providers succeed in explaining their sustainability approach sufficiently and comprehensibly, they can effectively counter any greenwashing allegations.

The offence of greenwashing is committed if customers are deliberately misled about the sustainable characteristics of financial products or if their sustainable effect is intentionally overstated. Fund providers must have measurable and binding sustainability criteria in order to counteract this. Verifiable data forms the basis for transparently demonstrating the sustainable impact of their investments.

Standards come with advantages and disadvantages

Globally accepted standards are an instrument that can be used to tackle greenwashing. They specify when an investment fund is considered sustainable and can be marketed as such. The EU has recently adopted the Sustainable Finance Disclosure Regulation (SFDR) with the aim of protecting investors from greenwashing.

However, the current edition of the Sustainable Investment Study by the Lucerne University of Applied Sciences and Arts warns that the SFDR could have the opposite effect. This would apply in particular to SFDR funds under Article 8. Although this provision stipulates descriptions of ESG characteristics, these do not necessarily have to represent important positioning aspects of the fund. This is one reason why funds with divergent ESG characteristics and varying degrees of sustainability focus are subsumed under SFDR Article 8 – which opens the door to misunderstandings and sows the seeds for greenwashing allegations.

Country specifics make uniformity difficult

The USA and Switzerland are also developing their own sustainability standards and they indeed serve as guiding principles for asset managers and investors. As standards like these leave room for interpretation, providers of sustainable funds would be wise to report in detail, transparently, regularly and beyond the legally prescribed scope on the sustainability performance of their funds.

As the aforementioned study by the Lucerne University of Applied Sciences and Arts shows, funds that explicitly include sustainability terms in the fund name and have an investment focus on sustainability receive significantly better sustainability ratings than conventional funds. And they also have a C02e intensity that is 30 to 40 percent lower.

Providers are increasing transparency

Besides other fund providers, Zürcher Kantonalbank's Asset Management is also working on continuous improvements in the area of sustainable investments. Quarterly sustainability reports provide information on the sustainability performance of all actively managed funds. They are classified into ratings A to G according to the investments underlying the respective product.

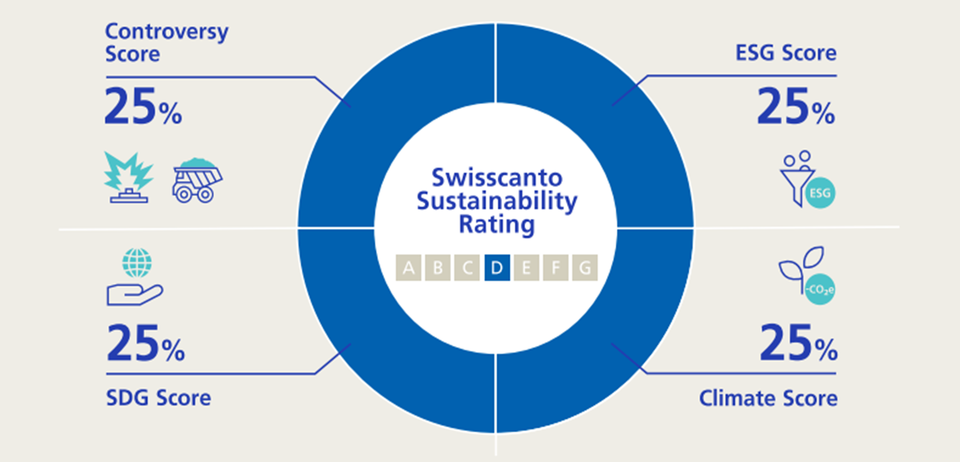

Another source of misunderstandings is the use of the term ESG. This is often understood as an umbrella term for sustainability. However, many ESG ratings identify the top companies within an industry with regard to their operational management (best-in-class approach). This means that a tobacco or weapons producer can also achieve high ESG scores. Customers typically focus on the question of how sustainable products and services are, or whether companies appear in a negative light in the media due to controversial behaviour or severe pollution. That is why we measure our investments along four sustainability dimensions (see chart).

Our approach to sustainability

The reports quantify the sustainability criteria applied and show their development transparently. An important aspect of sustainability is the climate target. Zürcher Kantonalbank's investment experts aim to reduce the CO2e intensity of investments by a fixed percentage amount, plus nominal economic growth, in the vast majority of active funds. For the Responsible fund range, this is at least 4 percent (2-degree climate target) and for the Sustainable fund range at least 7.5 percent (1.5-degree climate target).

Advice and financial knowledge are key

Asset managers must also provide clear customer advice. Advisers need to be able to transparently and comprehensibly explain what the fund can and cannot achieve with regard to various sustainability goals.

This helps avoid misunderstandings and disappointments. It is also advisable for all investors to deal with the topic. There is some catching up to do in terms of sustainable financial literacy. In November 2021, scientists at ETH Zurich determined the "sustainable financial competence" of around 3,000 Swiss investors. The result was sobering. Against this background, the state is also called on to improve financial knowledge among the population. This will ultimately lead to better investment decisions.

An abridged article from this blog appeared on 25 May 2022 in the print edition of the Handelszeitung's "Sustainability" special (available in German only).