Opportunities and risks of real estate funds with a discount

After the all-time high at the beginning of 2022, listed Swiss real estate funds experienced an historic slide in prices. The correction also caused valuations to plunge – and this has opened up opportunities.

Text: Flurin Joller

The weighted premium after deferred taxes in the SXI Real Estate Funds Broad (SWIIT) Index was 3.5% in mid-October of this year, the lowest in over 13 years. At 11%, the average premium (as at 20 December 2022) is higher again, but still significantly below the historical average of 23%.

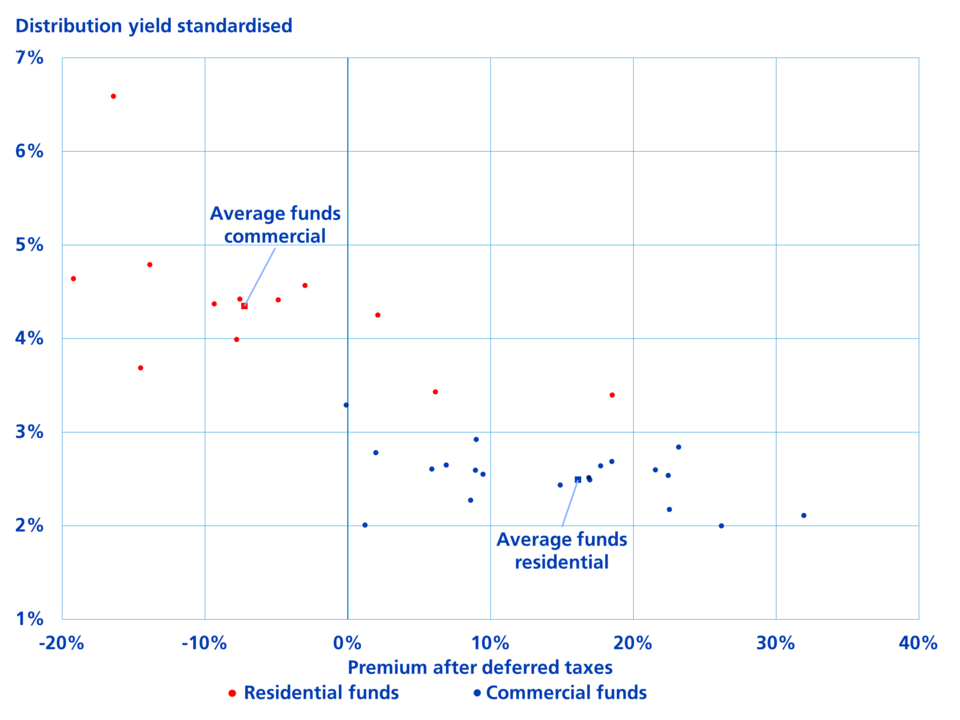

A closer look at the 41 listed real estate funds shows that the 14 funds that are listed below the net asset value (NAV), i.e. show a discount, include nine funds which are predominantly commercial use. The valuation difference between the housing and commerce segment is particularly evident in an analysis of these two peer groups.1 While funds with an investment focus on rental apartments have an average premium of 16%, funds concentrating on commercially used areas are discounted at an average of 7%. The valuation difference is a function of the current preference for the residential segment, which is considered more stable and reliable than its commercial counterpart. Funds with big discounts are also at risk of redemptions of units.

Attractive distribution yield for commercial funds

The low valuation also opens up opportunities. In the first place, negative market trends have already been factored into current prices. If these do not occur as expected, prices could recover. Secondly, based on the rental income collected from commercial funds, the yield is significantly higher than for residential funds at current prices. For comparative purposes, it is assumed that the net income generated will be distributed in full in the case of all funds. This standardised distribution yield is significantly higher at 4.4% thanks to low valuations for commercial funds than for residential funds at 2.5%.

During the period of negative yields, Swiss real estate funds were often favoured as an alternative investment to CHF bonds. The reason for this was the risk premium, i.e. the difference between the distribution yields of the funds and the yields on the bonds. Although this has now shrunk significantly in the case of residential funds, the risk premium for commercial funds remains at an attractive level.

In the case of commercial leases, increased inflation can be promptly passed on to rents. Rents are usually adjusted at the beginning of the year. As a result, commercial funds should generate higher rental income for 2023. In contrast, rental agreements in the residential sector can only be adjusted on the first termination date after an increase in the benchmark interest rate. However, this is not expected to occur until mid-2023 at the earliest. As a result, commercial funds should provide better protection against rising inflation in the short-term.

Risks due to rising interest rates

The prospects are less rosy due to higher interest rates. Firstly, higher interest rates can lead to rising discount rates and lower market values of properties. But based on the transaction market, only isolated devaluations have been observed by the appraisers. However, if there is a more pronounced correction in market values in the coming year, this does not necessarily have to be a problem. In the case of funds with discounts, this would even reduce the difference between the market price and NAV, and distribution yields are not directly affected by changes in NAV.

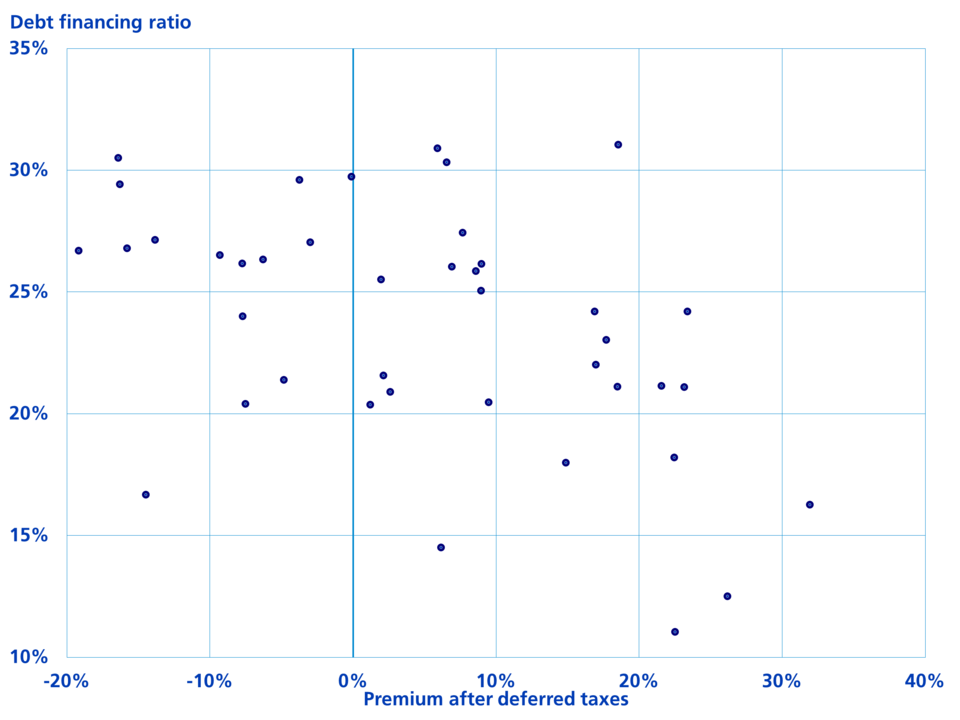

Secondly, higher interest rates inevitably lead to higher borrowing costs. The following applies: the higher the debt financing ratio and the shorter the remaining period of the liabilities, the greater the effect on net income and distribution substrate. As a result, distributions may be reduced for certain funds due to increased financing costs.

Funds with discounts combined with a high debt financing ratio are particularly at risk. If its properties are depreciated, the debt financing ratio could rise above the regulatory maximum limit of 33%. As it is not possible to raise capital in the discount, other drastic measures would have to be taken, e.g. sell properties.

Summary

The current stock market prices of listed funds already anticipate possible valuation corrections of properties or further interest rate increases in a historical comparison. On the basis of the distribution yield, we believe that funds geared particularly towards commercial areas still offer an attractive risk premium compared with yields on CHF bonds. However, an in-depth analysis of the portfolio quality of the funds is essential for assessing the opportunities and risks on the current stock market prices. Good locations of the properties and a solid tenant structure point to more stable cash flows – even in challenging market phases.

1 Funds from the SWIIT index with a share of at least 60% pure residential or commercial units in the portfolio.

Legal notices: the publications were prepared by buy-side research of Zürcher Kantonalbank’s Asset Management. The information contained in this document was not prepared in accordance with the statutory provisions promoting the independence of financial analyses and is not subject to any ban on trading following the publication of financial analyses.